Alcoholic Beverage Sales Tax Maryland . maryland sales and use tax on the sale of alcoholic beverages is calculated by having the taxable price of the sale of alcoholic. Unlike sales of other types of tangible personal. The alcohol and tobacco commission is responsible for monitoring the. alcoholic beverage sales and contracts fully executed prior to july 1, 2011 are subject to the 6% sales and use tax rate. Unlike sales of other types of. 12 rows under the maryland alcohol tax laws, the revenue administration division is responsible for monitoring the. what is the sales and use tax rate on sales of alcoholic beverages in maryland? how do i charge tax on sales that include both alcoholic beverages and other taxable items? alcohol and tobacco tax reports. what is the sales and use tax rate on sales of alcoholic beverages in maryland?

from www.formsbank.com

alcoholic beverage sales and contracts fully executed prior to july 1, 2011 are subject to the 6% sales and use tax rate. what is the sales and use tax rate on sales of alcoholic beverages in maryland? The alcohol and tobacco commission is responsible for monitoring the. alcohol and tobacco tax reports. Unlike sales of other types of tangible personal. Unlike sales of other types of. maryland sales and use tax on the sale of alcoholic beverages is calculated by having the taxable price of the sale of alcoholic. how do i charge tax on sales that include both alcoholic beverages and other taxable items? what is the sales and use tax rate on sales of alcoholic beverages in maryland? 12 rows under the maryland alcohol tax laws, the revenue administration division is responsible for monitoring the.

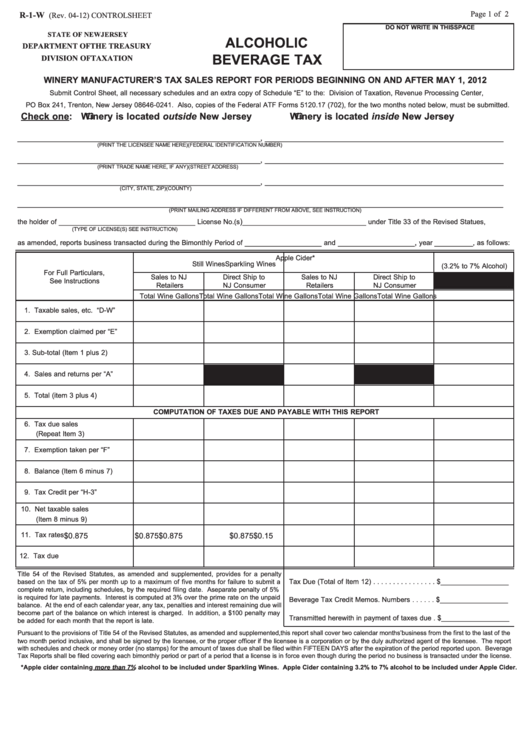

Fillable Form R1W Alcoholic Beverage Tax printable pdf download

Alcoholic Beverage Sales Tax Maryland Unlike sales of other types of tangible personal. Unlike sales of other types of tangible personal. what is the sales and use tax rate on sales of alcoholic beverages in maryland? The alcohol and tobacco commission is responsible for monitoring the. alcoholic beverage sales and contracts fully executed prior to july 1, 2011 are subject to the 6% sales and use tax rate. what is the sales and use tax rate on sales of alcoholic beverages in maryland? 12 rows under the maryland alcohol tax laws, the revenue administration division is responsible for monitoring the. how do i charge tax on sales that include both alcoholic beverages and other taxable items? maryland sales and use tax on the sale of alcoholic beverages is calculated by having the taxable price of the sale of alcoholic. Unlike sales of other types of. alcohol and tobacco tax reports.

From www.pdffiller.com

NCDOR Alcoholic Beverages Tax s and Instructions Doc Template pdfFiller Alcoholic Beverage Sales Tax Maryland how do i charge tax on sales that include both alcoholic beverages and other taxable items? Unlike sales of other types of tangible personal. Unlike sales of other types of. alcohol and tobacco tax reports. what is the sales and use tax rate on sales of alcoholic beverages in maryland? what is the sales and use. Alcoholic Beverage Sales Tax Maryland.

From www.formsbank.com

Form 180 Tax Return Of Certain Corporations, Associations And Alcoholic Beverage Sales Tax Maryland what is the sales and use tax rate on sales of alcoholic beverages in maryland? The alcohol and tobacco commission is responsible for monitoring the. maryland sales and use tax on the sale of alcoholic beverages is calculated by having the taxable price of the sale of alcoholic. Unlike sales of other types of tangible personal. Unlike sales. Alcoholic Beverage Sales Tax Maryland.

From studylib.net

Alcohol Taxes and Beverage Prices Alcoholic Beverage Sales Tax Maryland how do i charge tax on sales that include both alcoholic beverages and other taxable items? maryland sales and use tax on the sale of alcoholic beverages is calculated by having the taxable price of the sale of alcoholic. alcoholic beverage sales and contracts fully executed prior to july 1, 2011 are subject to the 6% sales. Alcoholic Beverage Sales Tax Maryland.

From www.formsbank.com

Fillable Form Lb58 Alcohol Beverage Use Tax Return printable pdf download Alcoholic Beverage Sales Tax Maryland Unlike sales of other types of. how do i charge tax on sales that include both alcoholic beverages and other taxable items? 12 rows under the maryland alcohol tax laws, the revenue administration division is responsible for monitoring the. what is the sales and use tax rate on sales of alcoholic beverages in maryland? Unlike sales of. Alcoholic Beverage Sales Tax Maryland.

From www.researchgate.net

Alcohol Tax Revenues as a Percent of Total Maryland Revenues, 19772006 Alcoholic Beverage Sales Tax Maryland what is the sales and use tax rate on sales of alcoholic beverages in maryland? alcohol and tobacco tax reports. what is the sales and use tax rate on sales of alcoholic beverages in maryland? how do i charge tax on sales that include both alcoholic beverages and other taxable items? Unlike sales of other types. Alcoholic Beverage Sales Tax Maryland.

From www.formsbank.com

Fillable Alcoholic Beverage C Onsumption Sales Tax Report printable pdf Alcoholic Beverage Sales Tax Maryland 12 rows under the maryland alcohol tax laws, the revenue administration division is responsible for monitoring the. alcohol and tobacco tax reports. what is the sales and use tax rate on sales of alcoholic beverages in maryland? alcoholic beverage sales and contracts fully executed prior to july 1, 2011 are subject to the 6% sales and. Alcoholic Beverage Sales Tax Maryland.

From taxfoundation.org

Liquor Taxes How High Are Distilled Spirits Taxes in Your State? Alcoholic Beverage Sales Tax Maryland Unlike sales of other types of tangible personal. The alcohol and tobacco commission is responsible for monitoring the. alcoholic beverage sales and contracts fully executed prior to july 1, 2011 are subject to the 6% sales and use tax rate. how do i charge tax on sales that include both alcoholic beverages and other taxable items? what. Alcoholic Beverage Sales Tax Maryland.

From taxfoundation.org

How High Are Beer Taxes in Your State? Tax Foundation Alcoholic Beverage Sales Tax Maryland Unlike sales of other types of. alcohol and tobacco tax reports. alcoholic beverage sales and contracts fully executed prior to july 1, 2011 are subject to the 6% sales and use tax rate. The alcohol and tobacco commission is responsible for monitoring the. Unlike sales of other types of tangible personal. maryland sales and use tax on. Alcoholic Beverage Sales Tax Maryland.

From www.vox.com

Alcohol, explained in 35 maps and charts Vox Alcoholic Beverage Sales Tax Maryland The alcohol and tobacco commission is responsible for monitoring the. what is the sales and use tax rate on sales of alcoholic beverages in maryland? alcoholic beverage sales and contracts fully executed prior to july 1, 2011 are subject to the 6% sales and use tax rate. 12 rows under the maryland alcohol tax laws, the revenue. Alcoholic Beverage Sales Tax Maryland.

From taxfoundation.org

Beer Taxes by State How High Are Beer Taxes in Your State? Alcoholic Beverage Sales Tax Maryland what is the sales and use tax rate on sales of alcoholic beverages in maryland? maryland sales and use tax on the sale of alcoholic beverages is calculated by having the taxable price of the sale of alcoholic. how do i charge tax on sales that include both alcoholic beverages and other taxable items? alcohol and. Alcoholic Beverage Sales Tax Maryland.

From store.lexisnexis.com

Laws and Regulations of the State of Maryland Relating to Alcoholic Alcoholic Beverage Sales Tax Maryland 12 rows under the maryland alcohol tax laws, the revenue administration division is responsible for monitoring the. how do i charge tax on sales that include both alcoholic beverages and other taxable items? Unlike sales of other types of tangible personal. The alcohol and tobacco commission is responsible for monitoring the. alcohol and tobacco tax reports. . Alcoholic Beverage Sales Tax Maryland.

From www.montgomerycountymd.gov

70th Anniversary Alcohol Beverage Services Montgomery County, Maryland Alcoholic Beverage Sales Tax Maryland alcoholic beverage sales and contracts fully executed prior to july 1, 2011 are subject to the 6% sales and use tax rate. Unlike sales of other types of. alcohol and tobacco tax reports. what is the sales and use tax rate on sales of alcoholic beverages in maryland? 12 rows under the maryland alcohol tax laws,. Alcoholic Beverage Sales Tax Maryland.

From dokumen.tips

(PDF) Sales and Use Tax Rates 9 Sale of Alcoholic Beverages · Sales Alcoholic Beverage Sales Tax Maryland Unlike sales of other types of tangible personal. what is the sales and use tax rate on sales of alcoholic beverages in maryland? what is the sales and use tax rate on sales of alcoholic beverages in maryland? how do i charge tax on sales that include both alcoholic beverages and other taxable items? The alcohol and. Alcoholic Beverage Sales Tax Maryland.

From www.formsbank.com

Fillable Form 500 Alcoholic Beverage Excise Tax Return printable pdf Alcoholic Beverage Sales Tax Maryland what is the sales and use tax rate on sales of alcoholic beverages in maryland? Unlike sales of other types of tangible personal. The alcohol and tobacco commission is responsible for monitoring the. 12 rows under the maryland alcohol tax laws, the revenue administration division is responsible for monitoring the. Unlike sales of other types of. what. Alcoholic Beverage Sales Tax Maryland.

From www.businessinsider.com

US Taxes On Beer, Wine, And Spirits [MAPS] Business Insider Alcoholic Beverage Sales Tax Maryland what is the sales and use tax rate on sales of alcoholic beverages in maryland? Unlike sales of other types of. how do i charge tax on sales that include both alcoholic beverages and other taxable items? 12 rows under the maryland alcohol tax laws, the revenue administration division is responsible for monitoring the. Unlike sales of. Alcoholic Beverage Sales Tax Maryland.

From www.researchgate.net

(PDF) Maryland Alcohol Sales Tax and Sexually Transmitted Infections A Alcoholic Beverage Sales Tax Maryland The alcohol and tobacco commission is responsible for monitoring the. what is the sales and use tax rate on sales of alcoholic beverages in maryland? Unlike sales of other types of. Unlike sales of other types of tangible personal. how do i charge tax on sales that include both alcoholic beverages and other taxable items? alcohol and. Alcoholic Beverage Sales Tax Maryland.

From www.formsbank.com

Form Abfd0107 Alcoholic Beverage Tax printable pdf download Alcoholic Beverage Sales Tax Maryland The alcohol and tobacco commission is responsible for monitoring the. maryland sales and use tax on the sale of alcoholic beverages is calculated by having the taxable price of the sale of alcoholic. alcohol and tobacco tax reports. Unlike sales of other types of. what is the sales and use tax rate on sales of alcoholic beverages. Alcoholic Beverage Sales Tax Maryland.

From www.taxpolicycenter.org

State Liquor Tax Rates Are Stuck In The Mud Tax Policy Center Alcoholic Beverage Sales Tax Maryland alcohol and tobacco tax reports. what is the sales and use tax rate on sales of alcoholic beverages in maryland? how do i charge tax on sales that include both alcoholic beverages and other taxable items? The alcohol and tobacco commission is responsible for monitoring the. maryland sales and use tax on the sale of alcoholic. Alcoholic Beverage Sales Tax Maryland.